Greenbuild 2024: Built to Scale

The theme for Greenbuild 2024 is "Built to Scale," spotlighting the green building community’s commitment to wholesale market transformation, bringing proven solutions and strategies to global communities.

Join us in Philadelphia, PA, November 12-15, 2024, for a new chapter in the green building movement.

Registration Is Open!

Greenbuild 2024 registration is officially open! Join us in Philadelphia from November 12-15 for an unforgettable experience dedicated to scaling up sustainability in the built environment.

This year's theme, "Built to Scale," underscores our collective dedication to transforming markets worldwide with proven green building solutions. Get ready for four days packed with innovative ideas, impactful strategies, and meaningful connections.

NEW April Webinar

Register for Greenbuild's newest webinar, Phius 101 for Architects, on Tuesday April 23rd, 2024, at 1pm ET.

Phius 101 teaches architects how passive house principles can be put into practice to create safe, resilient, comfortable and most importantly energy efficient structures, from commercial to residential to multifamily. Phius 101 explains how Phius certification includes third-party quality control as well as an iterative design review process that makes it the only passive house standard that truly guarantees the quality of its certified buildings. Phius certified projects are proven to use 40-60 percent less energy than code-built buildings at minimal to no upfront cost premium.

The Phius 101 is a 45-minute (incl. 15 min Q&A) introduction to Phius and Passive House, the history and evolution, the passive building principles and dynamic modeling tools. We will dive into the benefits of continuous insulation, the right balance between heat gain and heat loss through windows and shading, air-tight construction, and balanced ventilation with energy recovery.

Inside the Fifth National Climate Assessment

There are a number of key themes from the assessment as a whole that help set the stage for where the U.S. currently stands on climate change and how it relates to the built environment. This whitepaper will cover topics including:

- The Fifth National Climate Assessment’s report on “Built Environment, Urban Systems, and Cities.”

- How urban areas are drivers of climate change and represent an opportunity for adaption and mitigation.

- Key attributes of the built environment that exacerbate climate impacts.

- Equitable outcomes from a community-led approach to climate change.

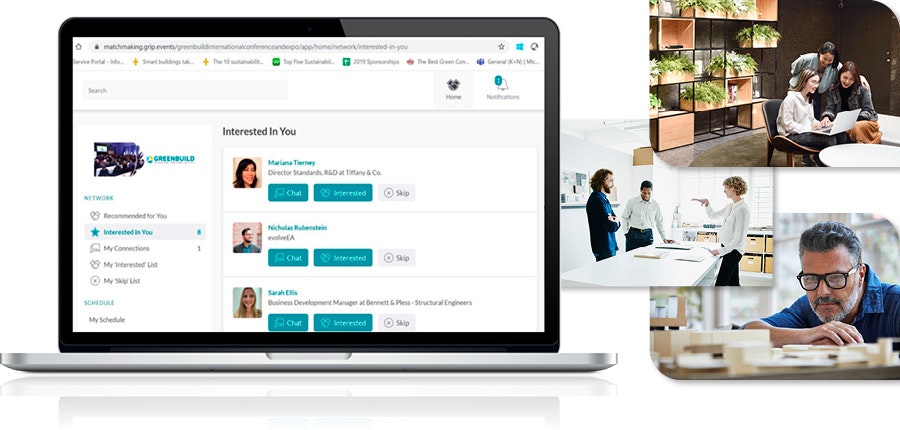

Introducing Greenbuild Connections: Your Event Recap

Our NEW platform, Greenbuild Connections, is our all-new 2023 event recap designed for you to continue key conversations with suppliers, read summaries from top-attended sessions, watch interviews from industry leaders, and learn more about the launch of LEED v5. Access Greenbuild Connections for thought leadership, event photos, and more!

Get An Inside Look at Greenbuild 2023

“Our goal with Greenbuild each year is for attendees to leave the event feeling inspired and equipped to tackle the biggest challenges facing our communities head on. And this year’s event was no different. From LEED v5's vital focus on decarbonization, equity, health, ecosystems, and resilience, to the inspirational insights from our keynote speakers, Greenbuild 2023 brought together the powerful ideas, proven solutions, and passionate individuals needed to a sustainable future for all."

-Peter Templeton, president & CEO, U.S. Green Building Council.

Inside the Greenbuild 2023 Legacy Project

The Greenbuild Legacy Project is an initiative that leaves a lasting impact on the host city of each Greenbuild International Conference and Expo. This year’s project selected by our local host committee was the Gensler’s “Roots to Success” initiative at Kelly Miller Middle School. Located in the heart of Ward 7 of Washington, D.C., Kelly Miller Middle School is an institution with a rich cultural history and legacy. The school serves a diverse population of students, many of whom come from families with limited resources. The school is also situated in a food desert, where access to fresh, healthy food is limited. The project aims to address these issues by making impactful improvements to two of the school’s existing spaces. |

Partner with Greenbuild

Sponsor Greenbuild events and digital education experiences and access a global community of green building buyers from a single platform.

Whether you are looking to sponsor, exhibit, advertise or educate, Greenbuild has the networking events, educational opportunities and unique marketing platforms and data to successfully boost your business.

GREENBUILD ACHIEVEMENTS

EIC Platinum

The Events Industry Council is pleased to announce that Informa Connect’s Greenbuild International Conference & Expo, the premier event for the green building and green spaces industry, has achieved Platinum Level certification to the EIC Sustainable Event Standards.

The standard specifies performance criteria in the areas of organizational management, marketing, communications and engagement, climate action, water management, materials and circularity, supply chain management, diversity, equity and inclusion, accessibility, and social impact. The Event Organizer standard is one of seven comprehensive standards for environmentally sustainable meetings.

TRUE Gold

Green Business Certification Inc. (GBCI) team has granted Greenbuild 2022, the TRUE Gold-level certification.

This achievement is a signal that Greenbuild is leading in minimizing waste output, becoming more resource efficient and environmentally responsible. We value your partnership towards a common goal of building a healthy, sustainable future for all.

CARBONNEUTRAL® EVENT CERTIFICATION

CarbonNeutral® Event Certification is a designation that demonstrates our event has achieved carbon neutrality in line with the CarbonNeutral Protocol. This certification is administered by Climate Impact Partners, and is a global standard managed for over 20 years to deliver clean, conclusive, and transparent carbon neutral programs. This initiative is part of the FasterForward - Faster to Zero commitment to becoming completely carbon neutral as a business by 2025 by our parent company, Informa.

Fastest 50

Greenbuild was ranked as one of the fastest-growing shows in the United States and will be honored at this year’s Trade Show Executive’s Fastest 50 Awards & Summit. Greenbuild secured awards in three categories. View the winners here.

An Unforgettable Keynote Experience

At Greenbuild 2023, Ali Zaidi, National Climate Advisor for the Biden-Harris Administration announces that the White House will launch a process to engage the industry in developing a federal definition for "zero-emissions buildings," accelerating capital formation around buildings that are not contributing to the root cause of climate change.